Charitable Remainder Annuity Trust

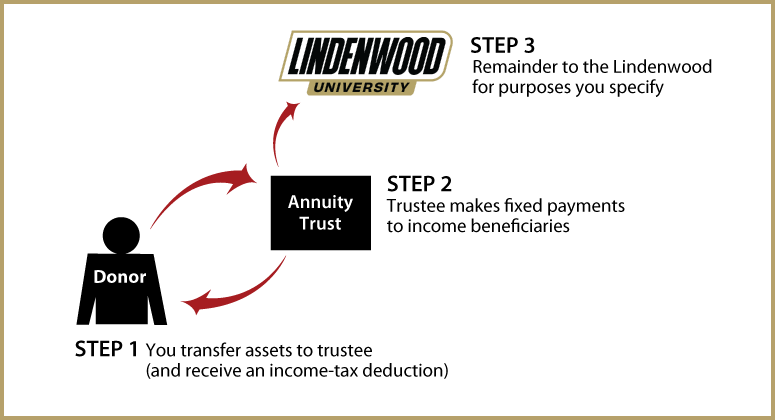

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to Lindenwood for purposes you specify

Benefits

- Payments to one or more beneficiaries that remain fixed for the life of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust property is sold

- Trust remainder will provide generous support for Lindenwood

More Information

Request an eBrochure

Request Calculation

Contact Us

Ken Meyer |

Lindenwood University |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer